While the staff was too overworked to feed Mr. Furumura, they were under strict orders from the nursing home’s owner to give the 96-year-old excessive amounts of physical therapy. Surely food or water would have been more helpful, but the horrific truth of corporate-run nursing homes is that they make unimaginable sums of money from taxpayer-funded programs like Medicare and Medicaid. The more “therapy” that homes administer, the better for the business’s bottom line. And best of all (for them): The state picks up the tab.Such financial incentives lead many for-profit nursing home operators to give patients treatments they don’t need. In the case of Jack Furumura, not only was such rigorous therapy totally unnecessary, it was reckless and flat-out outrageous. After 3 weeks, he had to be discharged directly to a hospital. He died only a few weeks later.

While the staff was too overworked to feed Mr. Furumura, they were under strict orders from the nursing home’s owner to give the 96-year-old excessive amounts of physical therapy. Surely food or water would have been more helpful, but the horrific truth of corporate-run nursing homes is that they make unimaginable sums of money from taxpayer-funded programs like Medicare and Medicaid. The more “therapy” that homes administer, the better for the business’s bottom line. And best of all (for them): The state picks up the tab.Such financial incentives lead many for-profit nursing home operators to give patients treatments they don’t need. In the case of Jack Furumura, not only was such rigorous therapy totally unnecessary, it was reckless and flat-out outrageous. After 3 weeks, he had to be discharged directly to a hospital. He died only a few weeks later.

Meanwhile, the nursing home received $600 from the state for each day they administered their therapy. All told, the Federal Insurance Program for the Elderly and Disabled paid $13,468.19 for Mr. Furumura’s “care” –– and he is only but one of hundreds of patients likely on similar regimens. Mr. Furumura’s case is, sadly, not unique — private homes rake in money for overworking and ultimately killing people they’re charged to protect. Nationally, private nursing homes overbill Medicare by at least $1.5 Billion every single year.

How is it possible that such heartless business tactics are being used in an industry that already profits billions? Why pick on an elderly population for a few extra dollars in a market that has no shortage of cash flow — and worse, in a market that capitalizes on vulnerability and death?

Nationally, private nursing homes overbill Medicare by at least $1.5 Billion every single year.Source 1

For-Profit Homes: Under-Funded and Under-Staffed to the Max

There are about 1.6 million men and women in U.S. nursing homes. At least 33 percent of them suffer from malnutrition or dehydration. That’s over 530,000 human beings starving inside of facilities that are built and intentioned to be centers of care. And the trend isn’t new; in fact, it’s been going on since before the turn of the 21st century: A 2000 study found that the extent of malnutrition and dehydration in some American nursing homes through the 90s was comparable to that found in many poor, developing countries. These miserable conditions exist not because nursing homes don’t have enough food and water on hand, but because they don’t have enough staff members to assist disabled residents with eating and drinking.

And how does this understaffing occur? By nursing home owners deliberately not hiring enough people in an effort to keep costs minimal.

Companies like the New Jersey-based nursing home chain, Synergy, have a history of underfunding their facilities to disastrous levels. Recently, 2 residents were killed in the span of only 4 months by staff negligence at a Synergy-owned facility in Wilmington, MA. In one incident, nursing assistants dropped a resident on the floor. The other incident involved a resident who was left unattended for an entire night, immediately after she’d fallen from her bed. The staff found her dead at 5:30AM the following morning.

In 2014, a Synergy facility in Brockton, MA was committing health and safety violations at 3.5 times the rate of any other home in Massachusetts. Nevertheless, the owners of the home pulled out over $2 Million from its budget to pay themselves and executives instead of hiring more staff. A nurse who worked at the facility told the Boston Globe she "had to do battle to get basic nursing supplies," while at the same time, Synergy’s owners bought a $25,000 suite at Gillette Stadium for the sole purpose of convincing a group of doctors to refer new clients to their troubled nursing home.

Think about this — a company that can’t even keep its current residents alive, much less healthy, refuses to buy nursing equipment and instead spends tens of thousands of dollars (of company profits) on football tickets to bribe doctors to refer yet more patients. It’s a way of thinking that’s as insane as it is dangerous.

At least 33 percent of the 1.6 million men and women in U.S. nursing homes suffer from malnutrition or dehydration.Source 2

Investors are willing to let residents die because it’s ultimately cheaper for them to deal with lawsuits than to hire the correct amount of full-time employees.

Dr. Penelope Shaw, with her lifetime’s worth of advocacy experience, knows the real story behind these criminally under-equipped facilities — they’re not due to a lack of funding, but are cold, calculated decisions made on the part of private nursing home operators:

"What we know anecdotally is that the accountants at the big for-profits have told their investors, board members, and corporate management that it's cheaper to pay liability in [court] cases than it is to staff properly across the country."

Put another way, investors are not just aware of the dangers of understaffing, they’re banking on it. They are willing to let residents die because it’s ultimately cheaper for them to deal with lawsuits than it is to hire the correct amount of full-time employees. In any other industry this would be not just immoral, but murderous – and yet it has become the norm in nursing homes. But how did the industry wind up there?

The Market’s Roots

Dr. Shaw told Sokolove Law that the appeal of nursing homes as a profitable market likely gained traction in the mid-1960s, when public insurance programs became the norm. Medicare provided private nursing home owners with, “a steady stream of income they could depend on," Shaw said.

Just because private homes make a lot of money doesn’t mean any of the profits go towards actually keeping residents safe. Instead they line the pockets of executives and Wall St. managers. "A lot of corporations are scooping up the money that could be used for direct care because you've got investors who, if they don't make money, are going to pull out," Shaw explained.

Robyn Grant, Director of Public Policy and Advocacy for The National Consumer Voice for Quality Long-Term Care, agreed with Shaw, telling Sokolove Law that for-profit homes run by multi-state franchises “are more likely to reduce spending on care for residents and to divert spending to profits and corporate overhead.”

Robyn Grant, Director of Public Policy and Advocacy for The National Consumer Voice for Quality Long-Term Care, agreed with Shaw, telling Sokolove Law that for-profit homes run by multi-state franchises “are more likely to reduce spending on care for residents and to divert spending to profits and corporate overhead.”Another correlation Grant identified? The top 10 most prominent for-profit nursing homes in the U.S. also had the lowest staffing levels, the highest number of deficiencies, and experienced the most errors and problems that were likely to harm residents.Simply put, private nursing homes are constantly strapped for cash because much of their revenue goes directly to the owners and investors rather than being reinvested in supplies and staff members. The most disturbing part of this revenue stream? Those same investors get their money from public programs like Medicare in the first place.

A Brief Look into the Price-Gouging Nursing Home Industry:

Corporate Owners Spend Less and Less While Making More and More

Investor Greed Demoralizes Staff and Can Lead to Resident Abuse

Poor funding and understaffing beats down the spirit of nursing assistants and can, in extreme cases, even lead to abuse. In one case, reported at a Rochester, NY facility, nursing aides posted a video to Facebook that featured employees pulling the hair of a wheelchair-bound resident. In the background of the video, voices could be heard threatening to "slap the black off" of the patient, as well as cursing at her.

There are all too many examples of such behavior, often committed by exhausted, overworked, and severely underpaid employees. While staff members should never physically abuse residents — such behavior is of course never acceptable — it’s important to remember that bad nursing assistants are also the byproducts of a system built from greed. Often “staff [become] overtired, overstressed, and overwhelmed – making it hard to handle difficult situations,” Grant said. It doesn’t help that many certified nursing assistants struggle with outright poverty.

Nursing Homes in Texas are so underfunded that staff members "can go down to the drive-through window at McDonald’s or Wendy’s and make more money."

In Texas, nursing home professionals are apparently quitting in record numbers to work at — of all places — McDonald's. Nursing Homes in the Lone Star state are so underfunded that staff members "can go down to the drive-through window at McDonald’s or Wendy’s and make more money," according to Julie Sulik, a member of Southwest Long Term Management. Is it any wonder that more than 50 percent of employees in the residential care industry quit every year?

Kim White, a certified nursing assistant in Florida, started out earning $9.40 an hour and in 5 years only received a few 15-cent raises. Nursing home staff members like White make so little money that she must buy nearly-expired food to feed herself and her teenage son. Taking into account the fact that nursing assistants suffer 6 times the number of work-related muscle tears and broken bones as any other occupation, it makes sense that work at McDonald’s would look appealing.

Investment Firms Avoid Accountability with Maze-Like Business Structures

So how do neglected residents and scorned staff members get justice? Why isn’t anyone suing or regulating these private homes? The answer is pretty simple: For-profit nursing home operators have developed a web of legal loopholes in which they hide to protect themselves.

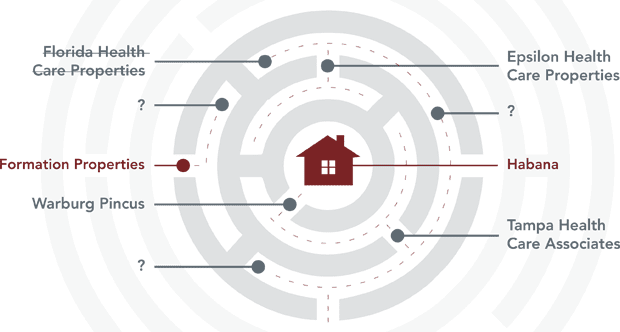

The basic strategy of nursing home owners is to avoid accountability by splitting the ownership of a single facility among dozens of different companies. In 1 head-spinning example, a nursing home named Habana was owned by 15 different companies and 5 different corporate firms.

See if you can follow this trail of corporate breadcrumbs:

A company called Formation Properties owned the real estate of a nursing home called Habana; however, Formation claimed it couldn't be held responsible for the nursing home because it had leased the real estate to another company called Florida Health Care Properties that had changed its name to Epsilon Health Care Properties that then subleased operation of the home to a company called Tampa Health Care Associates that is an affiliate with a private equity firm called Warburg Pincus.

Sound confusing? Well, that's not even half of the companies involved.

Corporate-run homes intentionally create these complex mazes of ownership so that lawyers and federal regulators can’t determine who’s at fault when a death or injury occurs to a resident. Spreading out ownership like this also creates legal cover for nursing home operators, managers, and executives to take Medicare and Medicaid money and put it directly into their own pockets. Regulators simply do not have the time or manpower to sift through the seemingly endless maze of paperwork and often just give up.

Corporations, on the other hand, do have the time. In fact, private investors know every trick imaginable to boost profits, and yet, for all of their money and cleverness, they consistently fail at delivering quality care. By stark contrast, many family-owned and non-profit nursing homes thrive without all of the financial schemes and unnecessary deaths.

Their secret? Simple as you could ever possibly imagine: caring about residents and reaching out to the community. Who would have thought such a simple thing could actually work?

What Can Wall St. Investors Learn from Non-Profit Homes? A Lot

While being an enormous, multi-state franchise helps many private companies generate a ton of cash, it also makes effective communication and management slow and sloppy. Dr. Shaw explained that, in contrast, many non-profit (and the few, successful private) nursing homes are often family-owned and operated. "You can move faster on things when [you’re smaller] and a lot of non-profits also get the local community involved," Shaw said.Community support is an important component of non-profits' success. These homes can draw on local volunteers, or receive food and clothing donations to increase their resources. Similarly, non-profit homes can make staffing adjustments more quickly than their corporate counterparts because "you don't need to go the corporate level to do things like increase wages and improve morale," Shaw said.

Perhaps the biggest advantage of being a smaller, community-oriented nursing home is that "they don't have to make a huge amount of money to keep investors happy." When non-profit homes receive money, they immediately re-invest in the essentials — quality staff and the correct supplies. Since millions aren't being siphoned off to fund an executive's new yacht, non-profits don't have to cut corners or rely on legal loopholes to survive.

Can a Corrupt System Be Reformed? Only if State and Federal Regulators Step Up

Private nursing homes have become strained, hopeless voids, where the people who need help the most and the people who most want to give help are turned into victims.

How is it possible that in an industry supposedly devoted to keeping our elders alive, employees and patients alike are literally starving? Yes, corporate greed and dirty business practices have a lot to do with it, but state regulators have also failed residents by not enforcing safety laws.

When non-profit homes receive money, they immediately re-invest in the essentials — quality staff and the correct supplies.

A $2,000 penalty for dropping residents on the floor or allowing them to fall is pocket change for many private companies.

One need not strain their eyes to find an example: In April of 2016, 7 nursing homes in the Hartford, CT area were fined for severe neglect and verbal abuse of residents. In each case, the fine was less than $2,000. A $2,000 penalty for dropping residents on the floor or allowing them to fall — incidents that often lead to broken bones and lost lives — is pocket change for many private companies. Such measly fines for colossal corporations of immense profitability are not only meaningless, they are hardly even symbolic. Further: What kind of precedent do they set for an industry rife with human rights violations?Grant is nevertheless hopeful. Consumer Voice is currently “advocating for a minimum staffing standard that would provide each resident with at least 4.1 hours of direct nursing care” each day. Better staffing laws may be the single-most important change to start saving our elderly population.

Other, state-level advocacy groups like Massachusetts Advocates for Nursing Home Reform and LeadingAge, a group that promotes and supports the good work of non-profits — are also busy calling attention to resident abuse and neglect. These groups are collectively raising their voices in Congress and the media, demanding that agencies get serious with enforcement.

But the question lingers: Why does it fall on individuals like Robyn Grant and Penelope Shaw to protect residents in the first place? And for that matter, how did we get to a point in the United States where we need a national network of advocates to protect the elderly and disabled from — of all things — their own healthcare professionals?

Consumer Voice is currently “advocating for a minimum staffing standard that would provide each resident with at least 4.1 hours of direct nursing care” each day.Source 3